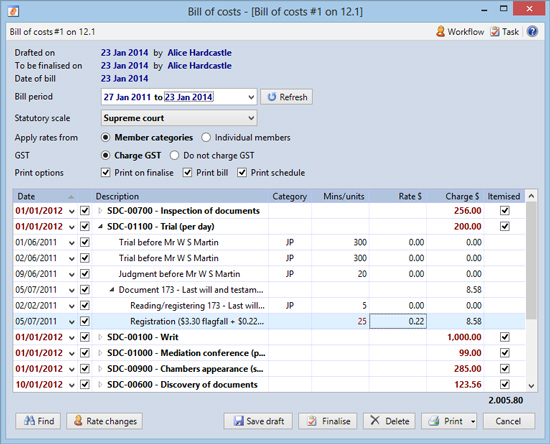

ContactsLaw offers features to assist in generating a

bill of costs for taxation purposes. Accessible from the 'bill of costs' heading under the Ledgers tab on a

file, the bill of costs

activity collates all

time,

fixed charges and

disbursements recorded within a given period, regardless of whether they have been billed to the

client. The records associated with a bill of costs are entirely separate from those of ordinary client billing; however it is not possible to include the same item on multiple bills of costs.

Rates and charges

While the normal

billing activity preserves the recorded value of each item, the bill of costs activity recalculates the charges by applying a

statutory scale. While the rates for recorded items are dependant on the cost agreement date on the file, rates for items on a bill of costs are always obtained from the scale as at the date the item was recorded. Fixed charges continue to use the rates as defined by their type. Disbursements are charged as-recorded.

Depending on the options, the bill of costs will apply rates from

member categories (and thus all members within a particular category will be grouped together) or from individual

members. You can also elect whether or not to include GST.

Since there exists the potential for rates to change during the lifespan of a matter, you can click the 'rate changes' button to view a summary of these changes.

Fixed charges

The bill of costs will attempt to aggregate fixed charges down to their most concise form. To that end;

- If the charge type has only a rate per unit (and no flagfall), multiple entries will be combined showing the total number of units recorded.

- If the charge type has only a flagfall (and no rate per unit), multiple entries will be combined showing the total number of entries (i.e. the flagfall becomes the new rate).

- If the charge type has both a rate per unit and a flagfall, each entry will be displayed separately.

Products

A product takes its charge policy from the date it bears; which, by default, is the date of the most recent time/charge recorded against it. It is possible to override the date and overall charge for any

product on a bill of costs. Changing the date of the product may cause a different charge policy to take effect. You can include/exclude individual time/charge records, as well as overriding the date and/or units for each. You can also override the description (excluding the scale item) of the product.

Regardless of the designation of product for each item, it is possible to move individual time/charges between products on a bill of costs, as well as arbitrarily adding products which were never recorded/billed on the file.

By default, only products charged on an as-recorded or maximum-cap basis are itemised; however, you can override which items are included on the schedule.

Document groups

As with client bills, the bill of costs groups the time/charges associated with documents. On the schedule, the time/charges for each document appear as a single item, showing a break-down of the time contribution for each category/member (or, for fixed charges, a summary of the charge items).

The date displayed beside each document group is taken from the most recent included journal/charge, but can be overridden. Although you can toggle the inclusion of the items that fall within a document group, you cannot break up the group or distribute the charges across multiple products. The charge is simply the sum of all included items.

Arbitrary groups

You can also arbitrarily group together journals, fixed charges and documents under a heading of your choice. These groups exist within a particular product and may not span multiple products. Their date comes from the most recent included journal/charge, but can be overridden. The charge is simply the sum of all included items. Groups cannot be nested inside each other.

On the schedule, you can elect whether to display each group as a single item (similar to a document group) or show the individual journals/charges.

| Note: Arbitrary groups which are not included ('ticked') on the bill of costs are not saved, nor are any items assigned to them. |

Disbursements

Disbursements also appear on the bill of costs, as a separate scale item (the item number being determined by the scale). The date of the disbursements item is taken from the most recent included disbursement; you can toggle individual disbursements on or off as needed. You can also override the description for each disbursement.

You can add disbursements which were never recorded on the file (or will be incurred during the taxation process) by right-clicking in an empty space in the grid and selecting the 'Add other item' command.

You can elect whether disbursements are included on the schedule or not. If not, they should appear itemised in the summary.

Court filing fee

If defined for the scale, a bill of costs may also include a lodgement/filing fee. The charge can be overridden as needed.

Workflow

During the taxing process, a bill of costs remains in a draft state. When accepted by the court, the record can be finalised. Further to finalisation, the paid/unpaid status of a bill of costs can be toggled, according to whether costs have been recovered. Once finalised, a bill of costs can no longer be altered.

Note that bills of costs in ContactsLaw are not designed to store the final ("taxed off") figures.